Pre-owned wristwatches are becoming increasingly popular in the world of luxury products. According to Boston Consulting Group (BCG) estimates, global sales of luxury secondhand timepieces exceed $22 billion in 2021, equivalent to approximately Rp 337.3 billion.

This trend is also visible in Indonesia, where the demand for pre-owned watches is increasing. This is because certain timepieces have high resale prices, making them a feasible investment alternative.

Table of Contents

ToggleLuxury Watches with a High Resale Value

Luxehouze has witnessed the resale of several pre-owned watch models that exceed their retail prices. Here are some of these notable timepieces:

1. Patek Philippe Aquanaut 5167R

The Aquanaut is one of Patek Philippe’s most renowned collections, with the 5167R model being particularly popular in the secondhand watch market. Sales of pre-owned variants of this product at Luxehouze have experienced a twofold increase from 2022 to 2023.

The watch’s universal design and size make it suitable for both male and female collectors. Its timeless and straightforward design ensures its relevance across generations, solidifying the Aquanaut 5167R as an everlasting timepiece.

This enduring quality piques the interest of many as an investment. Patek Philippe currently markets the Aquanaut 5167R for $45,540, or approximately Rp 698 million.

Pre-owned versions can be sold at higher prices than this amount. For instance, data from WatchAnalytics indicates that pre-owned versions of this watch are marketed within the range of 75,462 euros, around Rp 1.2 billion, representing a 41% increase over the original retail price.

2. Patek Philippe Nautilus 5711/1A Blue & White

In addition to the Aquanaut, the Nautilus collection by Patek Philippe also enjoys substantial demand. Specifically, the 5711/1A blue and white variants stand out at Luxehouze.

Pre-owned Nautilus 5711/1A Blue sales have doubled in 2023 compared to the previous year, while 5711/1A White sales increased thrice from 2022.

Patek Philippe no longer officially markets the Nautilus 5711/1A, making pre-owned options the choice for consumers. Due to their increasing rarity and continuous demand, discontinued timepieces tend to rise in value.

Thus, the pre-owned Nautilus 5711/1A achieves remarkable resale value. According to WatchAnalytics data, pre-owned versions of this watch can be sold for 115,983 euros, equivalent to Rp 1.9 billion.

3. Richard Mille RM11-03 Ti

Richard Mille stands as another brand that has excelled in creating watches with high resale value, exemplified by the RM11-03 Ti crafted from titanium.

Titanium is known for its watchmaking endurance, making the RM11-03 Ti very desirable. Its adaptable style works well for both professional and casual settings.

The RM11-03 marked Richard Mille’s entry into the chronograph watch segment and contributed significantly to the brand’s popularity in the watch industry.

Similar to the Nautilus 5711/1A, the RM11-03 Ti is no longer in production by Richard Mille. Its scarcity and desirability lead buyers to pay a premium for pre-owned versions.

Luxehouze experienced a twofold increase in RM11-03 Ti pre-owned sales in 2023 compared to 2022. Data from the Chrono24 marketplace indicates that secondhand RM11-03 Ti watches can be sold for prices ranging from Rp 3.7 billion to Rp 7.1 billion.

4. Patek Philippe Nautilus 5726A

As one of Patek Philippe’s best-selling products, the Nautilus 5726A naturally garners substantial interest, even in pre-owned variants. Its appeal lies in its simple design and relatively more affordable price.

The 5726A model is often compared to the 5740 Nautilus with a perpetual calendar dial. Although similar in design, features, and size, the 5726A holds more appeal due to a less cluttered dial appearance.

This distinguishing feature makes it popular among new luxury watch collectors. Patek Philippe currently markets the Nautilus 5726A at USD 50,860 or approximately Rp 779.6 million.

Despite its availability, many are willing to pay a premium for pre-owned 5726A models. WatchAnalytics reports that pre-owned versions of this watch can command prices starting from 77,434 euros, about Rp 1,28 billion, a 39% increase over the original retail price.

Luxury Watch Trends in Indonesia, Singapore, and Hong Kong

Over the past few years, interest in luxury watch industries has surged in Asian countries, particularly Indonesia, Singapore, and Hong Kong. In Indonesia this tendency is reflected in the significant import of timepieces and watch components into Indonesia.

According to data from the Indonesian Central Bureau of Statistics (BPS), as of June 2023, the import value of watches and timepieces reached $21.8 million, equivalent to Rp 335.5 billion.

Similarly, Hong Kong has witnessed a significant surge in interest. Data from the Federation of the Swiss Watch Industry (FH) indicates that luxury watch imports in Hong Kong reached 210.7 million Swiss Francs (about Rp 3.6 trillion) by June 2023, marking a 46.2% increase compared to the preceding period.

Both Hong Kong and Singapore rank among the top five countries with the highest imports of Swiss watches. FH data also shows that luxury watch imports in Singapore reached 158 million Swiss Francs (about Rp 2.7 trillion).

These figures underscore the substantial appeal of luxury watches in Asia, rivaling the import values in Western countries.

Factors Influencing the Price Increase of Pre-Owned Luxury Watches

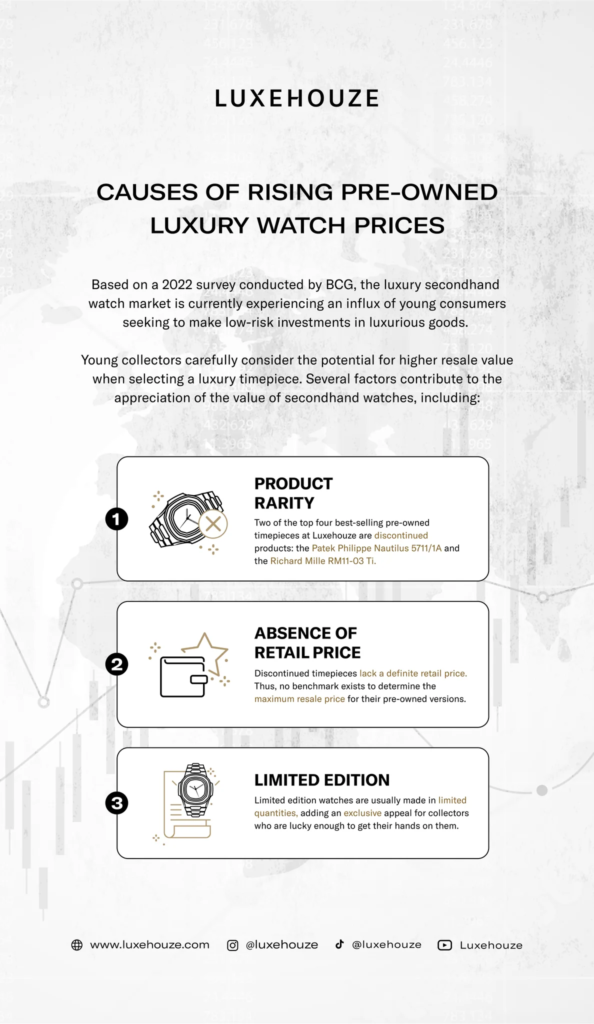

A 2022 survey by BCG revealed that younger consumers increasingly drive the market for secondhand luxury watches. Many of these individuals view luxury watches as relatively low-risk investment opportunities.

When purchasing luxury watches, young collectors often consider the potential for higher resale values. Several factors contribute to the rise in prices of secondhand watches, including product scarcity.

Numerous pre-owned watches sold at Luxehouze are discontinued models that continue to enjoy immense popularity. This scarcity factor drives their value higher.

The Nautilus 5711/1A watch serves as an example – it was discontinued by Patek Philippe in 2021, coinciding with its surge in popularity. The announcement of its discontinuation prompted an immediate increase in secondhand market prices.

Additionally, unlike actively produced watches, discontinued models lack fixed retail prices. This absence of a benchmark price influences the maximum resale value for pre-owned versions.

Limited edition products also hold the potential for competitive resale rates. Limited edition watches are often produced in limited quantities, imbuing them with exclusivity for collectors fortunate enough to acquire them.

Seasoned luxury watch collectors frequently seek out the rarest timepieces. Limited edition pre-owned watches can thus be marketed at higher prices due to their limited production numbers.

*The above data is estimative and should not be construed as investment recommendations